Decisions to invest are driven by estimated economic returns. When services are offered free to the public, having quantifiable measures of return is more complicated, but no less important. But how does one calculate economic returns for free-to-access digital offerings?

Over the last few years economists at the Department of Culture, Media and Sport (DCMS) have been developing methods to calculate the economic value to the public of cultural and heritage services. The goal here is to allow decision making around cultural investment to be consistent with the social cost benefit analysis principles published in HM Treasury's Green Book. This DCMS document from 2021 explains the framework.

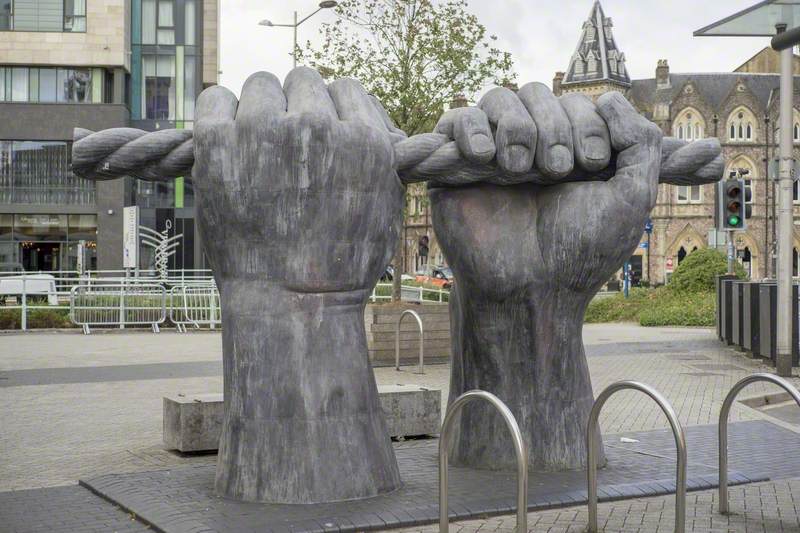

A particular focus of this work is calculating economic values for cultural and heritage services that are provided without charge to the public. To date most of these studies have focused on offerings of cultural institutions with tangible, physical services such as museums or galleries.

By contrast, few studies have been made of purely digital offerings. Art UK is therefore delighted to have become the subject of an in-depth case study around the economic value of digital culture published today by the DCMS, as part of its Culture and Heritage Capital (CHC) programme, in partnership with the Creative Industries Policy and Evidence Centre.

Following similar economic value studies, the approach taken in the Art UK study is based around what are called 'contingent valuation' techniques in which the study's authors survey users and non-users of a service to quantify what their 'willingness to pay' for the service might be in order to protect the service from hypothetical closure.

Typically, there are two key estimates of value in such studies. The first relates to users of the service. This is called the 'use value'. The second relates to people who do not use the service but are happy to put a positive value on it because they can see its importance to wider society. The studies of physical cultural and heritage sites have in the past shown that non-use value accounts for a significant part of their overall value proposition.

In theory, following such studies, decisions to invest would depend on comparisons between the economic value created and the cost of investment (or equivalently the annual value versus the annual cost of the service). Typically, where the ratio is greater than 1 that would be a trigger to consider investment.

In the case of Art UK, the published study has only been carried out on our UK audience (some 40% of the total). However, just for that audience and only taking into account the 'use value' of the Art UK offering, the calculated annual economic value is estimated at £71.4 million. This compares to Art UK's annual running cost of £1.5 million. That's even before we consider the non-use value. Although more difficult to aggregate, it is striking that over half of non-users said that they would or might be willing to make a payment for Art UK through additional taxation.

© the copyright holder. Image credit: McLean Museum and Art Gallery – Inverclyde Council

Ian McLeod (1939–2018)

McLean Museum and Art Gallery – Inverclyde CouncilIn conclusion, I am delighted that the Art UK case study has been published and am hugely grateful to the DCMS team for commissioning and publishing this study. It is pleasing to see that there is a desire in the DCMS to encourage more work in the area of valuing cultural digital offerings. In the meantime, I am proud that this Art UK study has helped to grow the related evidence base, and particularly pleased that, as the authors conclude, that the economic value estimates for Art UK are 'significant in magnitude'.

You can read the full study here. Not surprisingly this document is quite technical at times (and I say that having read Economics at university!). However, it does come with an excellent Executive Summary, which I would urge you to read.

Andrew Ellis, Chief Executive, Art UK